- #Best free payroll software for small business how to

- #Best free payroll software for small business full version

- #Best free payroll software for small business download

Network Access (Multiple users can share the same database)

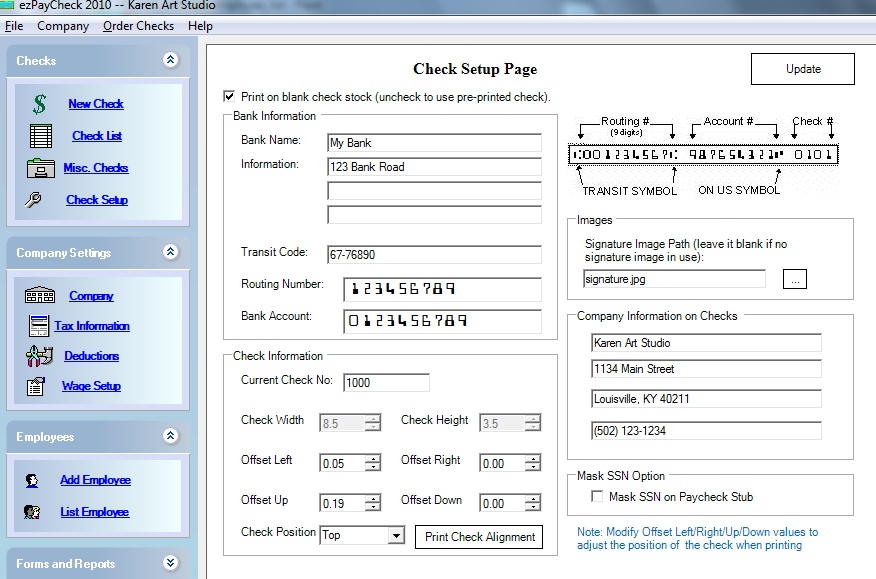

Prints paychecks on blank stock and preprinted check.Supports the differential pay rate for different shift or tasks.Employers can add custom payment such as Pay-by-piece, pay-by-load, pay-by-project, pay-by-mile and more.Church and companies have special needs can unchecks tax options.Monthly, Semi-monthly, weekly, biweekly and daily.Employers can add custom tax and deduction fields.Supports 401k, retirement plan, insurance deductions and more.Supports the options to withhold extra federal and state taxes.Automatically calculates Federal Withholding Tax, State tax, Social Security, Medicare Tax and Employer Unemployment Taxes.Built-in federal and 50 states tax tables.

#Best free payroll software for small business how to

#Best free payroll software for small business full version

(Note: The trial version is actually the full version with the only limitation that it will print the "Trial" images on checks, W2, W3, 940, and 941 forms.)ĮzPaycheck Payroll Software Runs on both Windows and Mac.

#Best free payroll software for small business download

Supports salary, hourly-rate, commission, tips and customized wages (such as pay-by-piece, pay-by-stop and pay-by-mileage).Calculates federal & state payroll taxes/deductions and the local taxes (such as SDI, occupational tax, city tax).Trusted by Thousands of Successful Companies Since Year 2005.

0 kommentar(er)

0 kommentar(er)